Architect Professional Liability Insurance

Architects, like other professionals such as engineers, doctors, and lawyers, are responsible for their work, which has a significant impact on others. Architectural project, from the concept stage to the construction documents, is complex work that requires compliance with numerous laws, regulations, and standards, while also paying attention to details. The project influences the quality of life, the comfort and safety of users, the proper operation of building systems, the aesthetics of the building and its spaces, and its economic value.

Architects’ professional liability insurance is designed to protect the architect and reduce the risk of lawsuits brought against them due to professional negligence or inadvertent errors. The insurance provides coverage for physical or financial damage caused to the customer or another party and also covers legal costs. In addition, the policy may include extensions for other issues, such as insurance covering damage due to loss of documents, breach of confidence, copyright protection, etc.

The developer, contractor, consultants, and architect may all face a lawsuit due to problems with the construction project.

This is why developers and construction companies require designers to provide valid professional liability insurance. It offers financial cover in the event of future claims against them.

The insurance is intended for the architect/company/business owner as well as the staff.

Among the insurance companies in this area, you can find Menora, Migdal, and others through insurance agencies including Madanes, Peltours, Shefi, and others.

Terms

• Annual turnover: the total revenue of the business per year (total revenue without deducting expenses or taxation).

• Liability limit: the maximum amount that the insurance company will pay in the event of a claim or claims.

• Liability limit per case: refers to the maximum amount for one case.

• Liability limit for the period: the maximum amount for all cases during the insurance period (typically one year).

• Personal liability: the amount the architect bears in the event of a claim.

• Third-party insurance – covers compensation for damage caused to a person who is not the insured architect.

Generally, in addition to professional liability insurance, third-party insurance is carried out. The difference between them is that professional liability insurance covers damage related to the professional negligence of the architect (for example, choosing slippery tiles for the balcony that caused damage to the apartment buyer), while third-party insurance covers damage that is not directly related to architecture, but more to accidents (for example, a client who slipped in the architect’s office).

• Employers’ liability: Employers’ liability insurance is intended to cover bodily injury only, which is caused to the employee during and as a result of their work for the insured, due to the insured’s negligence, during the insurance period, as a result of an accident or illness. In Israel, part of amount is covered by the National Insurance Institute (Betuah Leumi)

• Annual premium: the cost of insurance for a year.

Adviсe

• Unlike regular statutes of limitations, which start seven years after an incident, architects’ statute of limitations begins seven years after the damage occurs, not when the project finishes. This means that damage may not be discovered for many years after design and construction. Therefore, insurance coverage should start as early as possible and cover past projects. Architects must maintain liability insurance throughout their careers due to this.

• The insurance covers claims that have been filed, on the condition of receiving information about a case that may lead to a claim within the insurance period. Therefore, if a claim or information about a future claim is received by the architect, which is not brought to the attention of the insurance company at the beginning/renewal/during the insurance period, the company may refrain from retroactively covering the case.

• Professional associations representing thousands of insured individuals engage in “shopping” among insurance companies, attempting to secure better terms for their members at better prices. Therefore, one can find insurance companies offering discounts as part of agreements between the association and the insurance company, for example, for members of the architects’ association or for members of the organization of independent engineers and architects. It is advisable to check what discount is being offered and what the cost of membership in the relevant organization is in order to save money.

• You can lower the premium by increasing the amount of personal liability. As in the field of car insurance, a clean record and the absence or minimal history of claims reduce the cost of the premium.

So, for small claims, it’s better to deal with them directly instead of using the insurance policy. This way, it won’t impact your future premiums.

• For private construction projects and apartments, the typical coverage is usually around half a million shekels. For larger building projects, the standard requirement is coverage of approximately 4 million shekels. If there are one or two significant projects, it may be possible to maintain lower coverage for most projects and increase coverage only for specific projects, thereby keeping insurance costs lower.

• It is advisable to check a market – to receive proposals from 2-3 companies and compare them. Negotiations can also improve the conditions.

The Cost

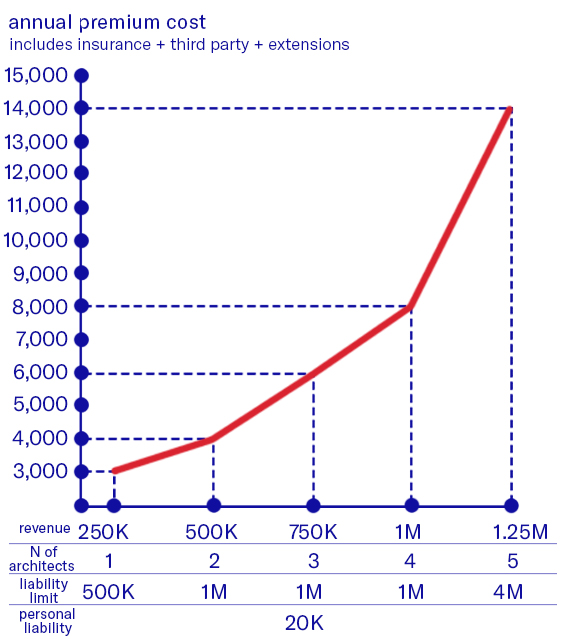

Insurance costs are typically determined by five parameters, including: the architect’s design areas, annual income turnover, number of employees, liability limit, and the amount of self-participation.

Below is a table of estimated insurance costs for architects (please note that the data is approximate only)